Personal Credit Card Portfolio Optimization: Hands-on

Reducing Debt Burden Through Payment Redistribution

Problem statement

If you have a number of loans, e.g. a mortgage, a car loan, a few student loans, a few credit cards (situation quite common in USA), it's easy to get drown in debt.

Typically, mortgages and student loans offer the lowest interest rates, while credit cards tend to have the highest, with car loans falling in between. In terms of repayment mechanics, mortgages and car loans generally require fixed monthly payments. Credit cards, on the other hand, offer more flexibility, allowing you to borrow and repay within your credit limits as needed. Student loans often have a more variable structure, which may include payments that adjust based on your income.

If you allocate a fixed amount each month — say, $1'500 — to your loans, it's often possible to reduce the total interest paid over time, thereby accelerating the repayment process. The mathematics of optimal loans payment is quite simple: prioritize paying off the loan with the highest interest rate first, and once that is cleared, move on to the next highest.

However, the reality is more complex. Most loans have minimum payment requirements, and some, like car loans, might charge fees for early repayment. Additionally, restructuring your loans to optimize payments can require navigating some paperwork.

Some of material below is marked as 'advanced' since it may require a deeper understanding of financial principles or more intensive thought. Feel free to skip these sections during your first reading and return to them later as you become more familiar with the overall concepts.

Pay-off strategies for debt reduction

What are some options for optimizing your debt?

One straightforward strategy is to focus on paying off the loan (usually a credit card) with the highest interest rate first (which is often referred to as 'avalanche' method), possibly using available credit from another card with a lower rate. This is often manageable online with just a few clicks.

Another approach is to borrow against your house (HELOC), and pay back the expensive credit cards, but if you save just a few hundreds dollars, it's a bad return on time spent filling out the countless forms and making a few calls.

Further strategy is the 'snowball' method, which involves paying off the loan with the smallest outstanding debt first. While this is not the most mathematically optimal strategy, it can be advantageous in terms of reduced paperwork and psychological benefits. Completing payments on a loan offers the satisfaction of reaching a milestone and decreases the number of loans needing attention.

Moreover, the outcomes of the 'snowball' method are often close to those of the 'avalanche' method, where the highest interest debts are prioritized. This similarity occurs because larger loans, like mortgages, usually have lower interest rates.

Thus, it's actually good to know how much would you save if paying back optimally. First, calculate without any constraints, second, with minimal required payments you actually have. I often see that thousands of dollars can be saved just by re-shifting payments between the loans. Why so? Because even a small difference in interest rates is multiplied by many years and by high outstanding debt.

Another thing, is the exponential nature of the interest rate. To illustrate the potential savings through loan optimization, I have developed a tool that provides concrete figures on what you can save: https://7cows.io/CC

Before exploring this tool, let's first understand the underlying dynamics of loans with fixed monthly payments.

Loan mechanics: example

E.g. assume you pay monthly a fixed payment (e.g. $1k) towards your car loan. What is not fixed, is the split up between the part that is due to interest and to outstanding debt. The part of interest in the monthly payment goes down exponentially (i.e. very fast) with time. If you can increase the overall payment (e.g. on the high interest rate credit card), the full power of the exponential effect kicks in earlier.

To make the example more concrete, assume the principal to be $50k taken at 12.86% for 6 years (link).

In the first month, the amortization part is less then half: $464.19, and more than half goes to pay the interest: $535.81. In the 8th month, the split is already 50/50, 4th year 4th month ca. $800 goes towards the principal, and ca. $200 to interest, and the last payment has only $10.60 due to interest.

Here's the table representation:

Debt optimization: example with 3 loans

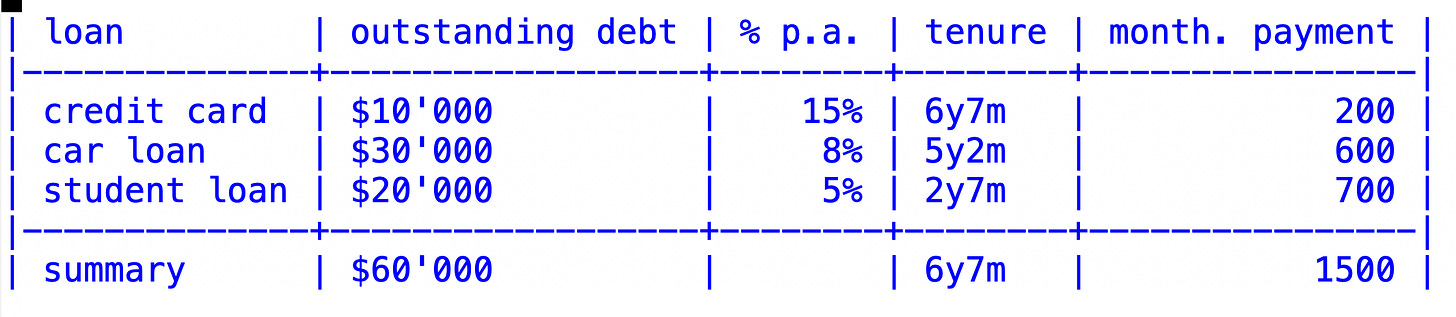

Let's consider a portfolio of 3 loans (link):

Credit card debt: $10k at 15% p.a. currently paying back $200 per month scheduled for 6 years and 7 months;

Car loan: $30k at 8% p.a. for 5 years and 2 months with $600 monthly payments;

Student loan: $20k at 5% for 2 years and 7 months with $700 monthly payments.

Captured as table:

The total outstanding debt is $60k (the sum of debts), the time to pay off is 6 years and 7 months (i.e. the longest of all 3) the monthly payment (at the beginning) is $1’500. The overall interest payments are $13’743.48 which corresponds to $1.23 payback for $1 borrowed.

The snowball method (link) is to pay the lowest outstanding debt first (i.e. CC, then student loan then car loan), it will bring down the debt burden to $1.18 per $1 borrowed.

The avalanche method is to pay the highest interest rate loan first (i.e. first credit card, then car loan then student loan).

The worst method is the opposite of the avalanche method, i.e. lowest interest rate loans first (i.e. first student loan, then car loan then first credit card).

If we start paying the highest interest rate first, we save more than $5k in interest (and 20 months in time) or 9c on every borrowed $1 by restructuring ALONE, i.e. we still pay the same amount per month, we just re-distribute where we pay first.

Results for different methods captured as a table:

Conclusion

We've explored both the theory and practical aspects of optimizing loan repayments on an individual level.

Given the vast amounts of consumer debts, this can have a huge positive impact at society level as well.

I tried my best to make the tool simple and intuitive, it may still presents challenges.

If you could use the tool and do the calculations, do help other people to do it: your friends, colleagues, members of your community or even on some online forum to do it.

p.s. Solve usury

This is practical implementation of the theoretical concept to fight usury by 'solving' it, read the article Solve usury for more details.

p.p.s. advanced material (can be skipped)

Some details to the example with 3 loans. You probably noticed the missing interest rate in the summary row, and strange remark if "initial" payment of $1'500.

Once one of the loans is paid, e.g. the student loan from the example, the monthly payment drops to $800. If you consider to spend extra $700 on one of the remaining debts, you need to make some assumption on which one.

Which is already an optimization decision. To make somehow the things comparable, I just fixed the payment schedule, i.e. whatever the method you would still have $1500 until 2nd year and 7th moth, starting from the 2nd year and 8th month you have $800.

It's not a convenient assumption, but it lets compare different methods somehow.

The portfolio of loans still has an EAPR interest rate (7.86% in this example) which wouldn't correspond to the $1500 of payment since after 2 years and 7 months it drops down. However, one can find the fictional monthly payment of a fictional mortgage if taking the outstanding debt of all 3 loans as its principle. As for the rest of parameters, the max tenure as its time period.

Figure out the interest rate (I came up with 8.69%) so that it corresponds to EAPR of 7.86% of the loan portfolio as its interest rate, and $1000 as the monthly payment (link).

Advanced debt representation.